Episode 192 Show Notes- 10 Ways to Solve the Enormous Student Loan Debt Crisis

↓ The P.A.S. Report Podcast is on every podcast platform! ↓

Episode Description

As the student loan debt crisis continues to grow, Professor Giordano explains how we got here. More importantly, he provides 10 things we can do to solve the problem once and for all. The student loan debt crisis a ticking timebomb about to explode, and many are pushing for the government to cancel out student loan debt. This places the debt burden on the backs of hardworking taxpayers. There are easier solutions that place the burden where it should be and don’t require scamming the American taxpayer.

Don’t forget to share this episode of The P.A.S. Report with family and friends, and on all your social media channels.

(You can listen to the entire episode by clicking the play button above or go to any podcast platform)

Show Transcript- 10 Ways to Solve the Enormous Student Loan Debt Crisis

P.A.S. Report Listeners Get 10% Off at Design It Yourself Gift Baskets! Use Code: PAS

*PA Strategies, LLC. earns a small commission when you make a purchase through any affiliate links on this website and within this post.

Intro

Welcome everyone to another episode of The P.A.S. Report Podcast.

I hope everyone is doing well out there. Before I start talking about today’s topic, I want to quickly mention what’s going on in Cuba.

The Cuban people are tired of communism and the misery it brings with it. Yet, here, we have millions of Americans pushing for socialism, and to empower government even more. Truly amazing when you think about that. Cubans are protesting and wishing for freedom and liberty as Americans push for greater government control. Anyone else see the irony in that?

Remember what Karl Marx said, Socialism is simply the first phase of communism. In any event, I’ll continue to monitor this situation, and provide an analysis of any major developments. I also want to just give you a brief update. As most of you already know, a few week’s I appeared on Tucker Carlon’s show, and I warned about the Biden administration’s National Strategy for Countering Domestic Terrorism. The other day, I appeared on Steve Malzberg’s show, Eat the Press. I have the link up in the show transcript so check it out.

I also released an episode on this where I go page by page through the document, and point out how it can easily be abused. There were some out there who said I was sensationalizing the document. Well, consider this…it’s just been reported that the Biden administration and the DNC plans to work with big tech and cellphone carriers to monitor and combat what they deem as misinformation. (Politico) Basically, if someone sends you a text message that the Biden administration deems as misinformation, particularly when it comes to COVID, essentially the cell phone carrier will send you a fact check.

This goes directly back to what I discussed in Pillar 1 where the private corporations will serve as the eyes and ears of the big government apparatus. Think about how invasive this is.

But that’s not all. There is something very few in the media industrial complex are talking about, and it was a tweet sent out by the FBI where they say family members and peers are “best positioned to witness signs of mobilization to violence.” (Twitter) They then call for family members and friends to report suspicious behaviors that may lead to homegrown violent extremism.

Now, they aren’t necessarily wrong there. Usually, family members are best positioned and there are warning signs that can be easy to spot. However, in this highly polarized era, this is extremely dangerous and goes right to Pillar 3, where I explained how they want to recruit individuals to essentially serve as narcs for anything deemed anti-government or anti-authority. See, the National Strategy for Countering Domestic Terrorism goes far beyond domestic terrorism, and this is the blueprint to usurp more power and authority from the people. To create the surveillance state that’s been in the making for quite some time, but I’m going to talk more about this next week.

For today, I have an important topic I want to cover. I want to focus on the student loan debt crisis that’s going to be a catastrophic fiscal disaster. This is an issue that has a significant impact on the audience because many are students currently going to school or recently graduated, and many are parents who have kids in college or maybe sending them to college very soon.

Even if you don’t have kids in college, you need to pay attention and listen to this because there are plenty of people out there who want you to be responsible for this problem.

I will provide 10 things we can do to solve this problem once and for all. And the beauty is that the solutions I offer won’t come at the expense of the taxpayers. The hard-working American men and women. The forgotten middle class constantly gets shafted and taken advantage of.

It’s time we put the burden where it should be. Enough with the scams. We need to wake up. So, in this episode, I’m going to explain how we got here, and what we need to do about it to actually solve the problem instead of kicking the can down the road like we normally do.

Before I get started, be sure to go to The P.A.S. Report website. While you’re there, sign up for The P.A.S. Report Newsletter, and be sure to subscribe to the podcast so you never miss an episode.

The Student Loan Debt Crisis

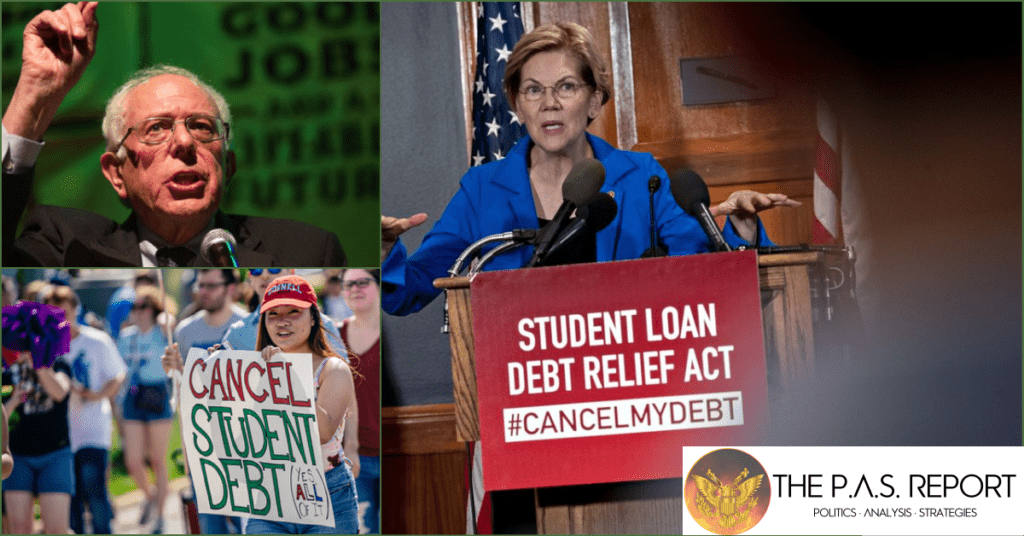

Now I wasn’t even planning on discussing the student loan debt crisis this week. Then, Senator Elizabeth Warren decided to send out a tweet calling for the cancellation of student debt. (Twitter) I responded to her pointing out 10 things we should do to end the student loan debt crisis once and for all.

Many of you reached out to me and wanted me to explain this further. See, I listen to the audience. Your voice matters here. It’s why I encourage you to signup for The P.A.S. Report newsletter because I’m going to be sending out a survey within a week or so, and I want to hear from you.

Getting back to my point. The student loan debt crisis has become a real problem. According to USDebtClock.org, student loan debt currently stands at $1.75-trillion, and that’s a catastrophe as so many do not have the means to realistically pay down the debt.

However, Senator Warren’s solution is to cancel out the debt, and that’s a huge mistake. First of all, you can’t just cancel out debt. The money has to come from somewhere, and when the government begins to “cancel” debt, who do you think is paying that debt off?

If you guessed we the taxpayers, you are correct. They want to put this on the backs of hard-working American men and women, even though the problem was created by the government in the first place.

It’s why I say they view us as the peasant class that they can continue to abuse. It was the ruling class, the elitists, that created this problem in the first place. And the problem slowly began in the 1980s.

At that time, Secretary of Education, Bill Bennett, called it out. He warned about this crisis when he said, “increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that Federal loan subsidies would help cushion the increase,” and the Bennett Hypothesis has been validated by several academic studies. (ERIC) Here we are over 30-years later.

As the federal government began building out new guaranteed loan programs, many colleges and universities increased tuition dramatically, much larger than the cost of inflation, because they knew that if students couldn’t pay, they would be guaranteed to take a loan. This at the same time we began encouraging everyone to get a college degree, and telling all generations that they wouldn’t be able to make a good living without one, which is far from the truth.

Consider that in 1990, students borrowed approximately $24-billion in student loans a year. Today, and for the last decade, students are borrowing over $100-billon per year. Some will argue that more is being borrowed due to more students going to college. While that accounts for some of the uptick, it doesn’t come close to covering the 352% increase in student borrowing leading to our current debt crisis.

Click Here to Get Your Copy of Speechless Today!

Canceling Debt is Irresponsible

Getting back to Senator Warren’s claim to simply cancel out the debt is grossly irresponsible for a variety of reasons.

First of all, what about all those who responsibly paid off their student loans or are paying them off. They did the right thing, and so essentially, they get screwed for doing the right thing.

And what about the parents that worked hard, took second jobs, didn’t go on vacations, or remodel their homes so they can make sure their children don’t graduate with student debt? What about the people who did the right thing? Again, those that did the right thing get shafted. Yet, you can have other people who may have worked hard, but they’ve recklessly spent their money. Going on vacations. Buying the things, they want and never saving a penny. So, they’ll get a pass because they didn’t plan properly?

And then you have the students. You have some that are extremely responsible. They take their obligations seriously, and so they made sacrifices. Maybe they bought a crappy used car so they wouldn’t have monthly payments. They didn’t max out credit cards, and they can begin to tackle their student loans. On the other hand, you have students who can’t pay their student loans, but they’re driving around in a $700 a month car, and thousands of dollars in credit card debt.

What about those who didn’t go to college? Why should they be on the hook for someone else’s student loans?

Also, if we’re going to bail out those who took student loans, what happens when people can’t afford their car? Should we cancel out their debt? What about a mortgage? I mean keeping a roof over people’s heads is pretty important. Should they get their debt canceled out too?

Now, this doesn’t mean that everyone who took out a loan and can’t pay it back is irresponsible. Some of them followed all the rules, and they just may have gotten shafted. There can be a variety of factors involved.

This is why some say that student loans should be discharged through bankruptcy. Again, discharging the loans through bankruptcy is essentially canceling the debt out, and since the government is the largest holder of student loan debt, it’s not like it’s a bank or financial institution that suffers, it’s the taxpayers that suffer because we are then responsible for the debt.

So here are my 10 points for solving this problem once and for all, and to make sure it never becomes a problem again.

Don’t take out more than you can afford.

Now, this might sound logical. It may sound simple enough, but far too many people don’t look long-term, and simply live in the here and now. They don’t look at the loan as real money, and therefore, they don’t take it seriously.

Go to the Department of Labor website and look at expected occupation growth rates and salaries.

This is one of the biggest problems I see as a Professor. Too many people never look at what occupational growth and salary growth for professions are projected to be. Well, you know what sucks. What sucks is when you go to college, get yourself into debt, graduate with a degree, only to find that your degree is now obsolete because a robot replaced your industry.

Take accounting, according to the Bureau of Labor Statistics, we are expecting to see a 6% decline and the loss of 95,000 accounting jobs between 2019-2029. (BLS) Does accounting seem like it would be a smart major right now? Now if you plan on becoming a CPA that’s different, but if you think accounting is a good field to get into, think again.

On the other hand, the data science field is projected to grow much faster than the average pace, and also the pay is much greater.

All this information is out there, you just have to look for it. I have a link up at The P.A.S. Report in the show transcript so go to the Bureau of Labor Statistics and do some research.

Once you have a career or major in mind, see if the salary to loan ratio and the cost vs. benefit analysis makes sense.

This is another big problem I see. When you look at some of the student loan debt held vs. the anticipated starting salary and median salary, the student loan debt far exceeds what it should. In most colleges, tuition levels are based on a per-credit basis regardless of major.

So, if you’re majoring in education, which has a median salary of $46,000, vs. someone who is majoring in engineering, which has a median salary over $90,000, it doesn’t matter, you are both going to be paying the same tuition rate. Most schools don’t have differential tuition where tuition costs go by major, and even for the ones that do, they still overcharge for majors that have lower-paying salaries.

Also. for most schools, 12 credits is considered full-time, and there aren’t additional charges for anything over 12-credits.

So, if you take 18 credits per semester, it’s like taking two free courses. Essentially, and you can potentially save thousands of dollars, if not tens of thousands of dollars, by shaving a year off education. Unfortunately, no one really tells the student or parents this, and I will say this is not for everyone especially if you are not self-disciplined and have a history of slacking. In that case, 18 credits would just overwhelm you. But everyone should be aware of this.

We also need to recognize that not everyone is an academic. We tell students that they have to go to college. They have to get a degree. It’s the only way they’ll get a good-paying job. That’s BS. There are plenty of jobs that you can do that don’t require a degree, and you can make a pretty good living especially if you learn a trade.

But the biggest problem I see is when students take out far too much in student loans, and the profession doesn’t really call for it. Take education. You want to be a teacher. Well, it doesn’t make sense to rack up $150,000 in student debt when you look at a teacher’s salary. Same thing with Police, or homeland security positions.

Far too many students have deluded themselves into believing that when they graduate college, they’re going to be making six figures. Sorry, but you’re not Hunter Biden. You may be smoking the same thing he does if you really think someone’s just going to hire you and throw all this money at you simply because you got a piece of paper.

And be careful what school you go to especially if you are going to work in the public sector. Let’s say you’re going to become a police officer or a teacher. You don’t get paid more because you went to a better college. Most of the contracts are negotiated and blanket contracts that cover all employees. You get the same salary increases and make the same money. So, what’s the purpose for having high student loan debt, making the debt crisis far worse, when you don’t have to. Why choose a more expensive college or university than you have to unless you’re specializing in a particular program?

Start off by going to a community college.

This is really important. There are far too many people who are so arrogant that they dismiss the idea of sending their kid to a community college for the first year or two. It drives me nuts. Okay, send your kid to a 4-year university and watch how many fail out within 2 or 3 semesters wasting a ton of money. Or send them straight to a 4-year school where they get completely brainwashed and indoctrinated.

Starting off at the community college level is not degrading. It’s actually the smart thing to do and benefits them in a variety of ways.

I have plenty of students that came from 4-year schools. They weren’t responsible enough and lacked self-discipline. So, they had a great time for a couple of semesters, but then they get booted. These students always tell me how they wish they started at the community college level.

Sending them to community college first allows students to get acclimated to college life, which is completely different than high school. It also provides them with a quality education at an affordable cost.

Think logically and tell me what makes more sense. You have Student A who goes to NYU and gets a bachelor’s degree in education spending about $300,000 on their education. Then you have Student B, who goes to a community college the first two years spending about $8,000-$10,000, and then transfers to a top state school spending about another $40,000.

All told, they both majored in education, both have degrees from respectable institutions, and the only difference is the person who went to community college saved a quarter of a million dollars. You tell me who the smart one is. Even if Student B ended up transferring to NYU, Student B would still be saving nearly $150,000, and guess what? Both of their diplomas would read NYU.

And while it’s still academia so community colleges lean left, they are not nearly as radical as the 4-year institutions. You don’t have the same far-left extremists because we have real diversity and real respect for opinions. Students come from all different backgrounds, socioeconomic statuses, some have kids, some are returning adults, some are taking care of parents.

Community college is more in touch with reality and that’s why it’s not a radical indoctrination camp. So, if for nothing else, it helps prevent the student from becoming a radicalized activist because when they go transfer to the 4-year school, they won’t be as naïve at 20 or 21 as they were at 18.

P.A.S. Report Listeners Get 10% Off at Design It Yourself Gift Baskets! Use Code: PAS

*PA Strategies, LLC. earns a small commission when you make a purchase through any affiliate links on this website and within this post.

Do away with the BS Majors that don’t lead to an actual career.

Sorry to all those who want to major in Caribbean Studies or Gender Studies, but you are being scammed. Too many colleges and universities offer too many BS degrees that have no prospect of really getting a career once you graduate. And there is nothing worse than going through school, working hard to earn the degree, only to work as a store clerk once you graduate.

I know too many people who got useless degrees, and they don’t even work in professions that they majored in. In fact, some of them are managers at some of the corporate retail stores, and they may make good money being a manager, however, they didn’t need to go into debt to get that job. In fact, most of some mid-level management positions don’t even require a college degree.

I see colleges and universities offer so many useless degrees that it’s sickening. You can get a bachelor’s or master’s degree in diplomacy. Guess what, just go to the State Department website, and look at the requirements to be a diplomat.

All you have to do is be over the age of 18 and pass the foreign services exam to become a Foreign Services Officer. Sure, a degree may be helpful once you pass the foreign service exam, but guess what, they don’t require a degree in diplomacy. And if you don’t pass the foreign services exam, what are you going to do with a degree in diplomacy?

Now, wouldn’t it be smarter to get a degree in Homeland Security, which has a high growth projection according to the Bureau of Labor Statistics? This way, if you don’t get to become a diplomat, at least you have tons of other opportunities out there, including at all levels of government and the private sector.

Let’s start to get rid of all the BS and have majors that are actually going to get students employed.

Investigate financial aid departments.

You know, Congress calls for tons of useless investigations. Remember, when they wasted our time and taxpayer money holding an investigation into the Major League Baseball steroid scandal? Well, here is something that Congress should be investigating.

There are far too many people in these financial aid departments encouraging students to take out the maximum student loans each and every semester. It’s not all of them, but a lot do engage in this practice. They tell the students it will cover tuition, books, and put some money in their pocket.

This is highly irresponsible, and this practice needs to stop now. I get books can be expensive, but a student can easily afford books working a part-time job on or off-campus. Also, loans shouldn’t be used for pocket money. Students have to pay these loans back with interest.

Students should take out the bare minimum when it comes to student loans, yet they are being encouraged to take out far more than they really need, and that does a disservice to the student, the student’s parent, and the taxpayer.

I’d like to know how this isn’t considered predatory lending. This leads me to number 7.

Hold Universities accountable.

Universities need to be held accountable. If they engage in predatory lending encouraging students to recklessly take out student loans, those colleges and universities should be held responsible for the loan. I can guarantee you they would quickly change their tune.

And if a college offers BS majors, again, they should bear the financial burden, not some students that they took advantage of. See, many universities will offer BS degrees and imply that if you get the degree, they will help you with job placement only to leave the student high and dry once the student graduates.

See, when you’re a former student, they no longer care about helping you because they already got paid.

If they had some financial stake in the outcome of the student, things would change, but since they don’t, they could care less about student outcomes, particularly those that are struggling. You notice that you never see a college advertisement that features a student explaining how much debt they’re in and how they can’t find a job.

Well, what if the colleges and universities had a stake in your success? What if we made the colleges and universities cosign the loans and guarantee them? How quickly do you think they will change their tune?

Again, I guarantee you that the colleges and universities would become much more responsible. Within a week, the colleges would be blasting out an email about majors that are no longer offered.

Pool all the university endowments and use that money to pay off student loans.

I have to say, this is by far my favorite idea. According to the National Center for Education Statistics, in the fiscal year 2018, the total endowments the colleges and universities totaled $648,043,073,000. (NCES)

Think about that. That’s a whopping $648-billion and that’s from 2018. That number surely has gone up. Consider this, these endowments are invested in investment funds and generate rates of return. So, if we look, on average, the endowments grow about 8-10% each year, in addition to the other contributions to the endowments. It wouldn’t surprise me if the total endowments were worth over $800-billion at this point.

Remind me, why are we looking for the government to cancel out debt? Remember, the overwhelming majority of these institutions are far to the left. In fact, they encourage socialism, and some go as far as Marxism. Now of course they are using capitalism to enrich themselves and make the endowments grow ever larger, but if they really believe in socialism, let’s take them at their word and put them to the test.

The $800-billion should be pooled and used to pay off student debt. Now that won’t take care of the total student loan debt crisis, but it would cut the crisis in half.

Some of you may ask how do we determine whose loans get paid from this fund? Well, simple. We can go by needs-based, then look at whether the financial aid department of whatever school engaged in nefarious practices, whether the occupation vs. the size of the student loan was proportional, and finally, whether the degree the person obtained was useful.

I love this idea. Think about it this way. It’s a win-win. If the colleges and universities try to fight this, then everything they preach is nothing more than lip service. You expose them for the frauds they are. They’re the ones pushing this socialist Marxist crap so let them put their money where their mouth is. They’re the ones brainwashing students so let them pay for that.

Also, how can anyone on the left complain about this? I challenge any Democrat out there, that’s been pushing this the far-left crap, to tell me that this plan is unfair. I dare you to. Are you really going to argue that ordinary, hard-working Americans should pay this debt over these wealthy institutions? Are you really going to argue that the wealthy institutions shouldn’t help those in need, especially those who may be minorities, and this relief would change their lives?

Once again, this is so obvious, but you have too many cowards that would never put the pressure on these institutions to do this. Whoever is running in 2022 should use this as a campaign issue because the idea is freaking genius.

Work hard, study hard, and do everything necessary to position yourself for a career.

Unfortunately, too many college students think that classes and grades are what matters most. I see this all the time. While grades and classes are important, it’s equally important to work hard in other areas. As a student or a parent of a student, there is much more to college and a college education than attending classes and getting good grades.

Too many students simply go through the motions thinking the piece of paper is all that matters. However, the truth is if you just go through the motions, attend class, pass classes, and get your degree, you’re in for a world of disappointment once you graduate. You’ll be sending out resume after resume, and you’re going to wonder why you haven’t gotten a callback. Even if you do get a call, and happen to get an interview, you’re not going to be offered what you think you are.

Experience is key. While in college you need to conduct internships. Now internships suck. No one likes to work for free or for pennies, but you have to suck it up. The internship gives you some real-world experience employers want to see, and it’s a resume builder. It also tells employers that they don’t have to train you from scratch.

You can think you know everything there is to know because you got an education, but guess what, real life doesn’t operate in some textbook. If you’re in emergency management, you can’t turn to page 194 in a textbook, and it tells you what to do. Only experience can do that.

But there’s something more valuable from the internship than just getting a little experience. The most important part of the internship is that you’re beginning to build your professional network that you can tap once you graduate.

Internships are about building relationships with people that are in a position to help you down the road. The harder you work, and the more you communicate with them, the stronger the relationship and the willingness to help you.

Once the internship ends, follow up and stay in touch to continue cultivating the relationship. If you do an internship, and never speak to anyone once the internship is over, you wasted an opportunity.

Also, while you’re in college, you should begin to join organizations, both civic organizations, and professional organizations related to your major. Attend the meetings and continue to network. The more relationships you have, the easier it will be to get the career you want once you graduate. Understand that each person you build a relationship with has an entire network of their own that they can use to help you.

Another important step is to begin to take civil service exams while in college. All too often, people wait until they graduate to take these exams and that’s a big mistake. Most of these exams have long waiting lists, and odds are you won’t be called for 3-4 years. If you begin taking these exams while in college, then by the time you graduate, you should be high enough on the list for a position.

And while in school, there’s nothing wrong with learning a trade at the same time. Trades will never go to waste. Think about something like plumbing, electrical work, carpentry, whatever. Even if you never become a plumber, it’s a skill you will always be able to use when you need to fix something. You can save yourself tons of money just by doing this work yourself on your own place, and if you’re really ambitious, you can use the trade as a side hustle once you’re in your career, allowing you to earn a second stream of income.

This leads me to the last point.

Take personal responsibility.

This last point is a crucial one. It’s pretty simple. Take personal responsibility. I know that for some this is a foreign concept, and that’s part of the problem with everything we’re witnessing today.

It’s time we became more proactive in our lives. Listen, life is rough. There are going to be good times and bad. You’re going to make some good choices, and then, if your anything like me, you’ll make a hell of a lot of bad choices.

But the important thing is to learn and grow. Always hold yourself accountable for your own actions, and don’t get bogged down with the little things.

We have to stop the constant blaming of everything else and look at ourselves in the mirror.

Understand, that you, and you alone, are in charge of your own destiny. You may have more obstacles than others, you may have less, but only you can determine the outcome of your future.

Be smart, don’t saddle yourself with debt for an education until you do the research and determine it’s something you need to do. And if school isn’t your thing, then get into an apprenticeship of some sort and learn a trade.

There are a lot of trades that make really good money. Not everyone is an academic and we need to stop pretending like they are.

Closing

I can guarantee you that if we do these 10 things, the student loan debt crisis becomes a nonissue. See, here at The P.A.S. Report, you get actual solutions to the problem.

Protect your privacy online with PureVPN

Online privacy is not optional. A VPN helps keep browsing more private by encrypting internet traffic, masking an IP address, and reducing exposure on public Wi-Fi. It also helps limit tracking and can support access to content when networks block or restrict it.

✅ Encrypts Your Data & Internet Traffic for Added Privacy

✅ Masks Your IP Address & Location

✅ Bypasses Geo-Restrictions & Censorship

✅ Helps Secure Public Wi-Fi Connections

*Disclosure: This site contains affiliate links. If a purchase is made through these links, PA Strategies, LLC may earn a commission at no additional cost to the buyer.

And how much would it cost to do anything I mentioned, and the answer is $0. That’s the beauty of this. Why wouldn’t try something like this first, and then if it doesn’t work, we can try other things.

But I’m not worried because I know it will work. However, if we do nothing, sooner or later the taxpayer will be responsible for the debt. Sooner or later, they’ll say the government has no choice but to step in.

The larger the debt bubble grows, the more Democrats and the left will say that we have to cancel the debt. Even worse will be the government takeover of the higher education system and implementing a universal college education program that will be nothing short of a disaster.

They’re already calling for it. And for some of you who may want to see a program like that, you need to understand there are tons of strings attached if you want a college education, including your ability to choose your own major. Choice will be out the window. While I’ve taken enough of everyone’s time already, let’s not continue down this path we will all regret, and just do the simple commonsense things I laid out.

Before I go, please take 30-seconds and provide The P.A.S. Report Podcast with a 5-star rating and write a quick review on any podcast platform that allows reviews.

Share this episode with family and friends. It’s because of you, the audience, that this podcast is rapidly growing and hitting new records each and every month. Our movement is an organic one, and our voices are important.

I want to thank you for joining me, I want you to stay safe, and I’ll be back next week.

The P.A.S. Report wants to hear from you. Send your feedback to podcast@pasreport.com. Please leave a 5-star rating and write a review on Apple Podcast.

Please share this episode with others & on social media.

P.A.S. Report Listeners Can Get Free Shipping and 35% Off Your Initial Order as a Preferred Customer! Use Code: PAS

*PA Strategies, LLC. earns a commission when you make a purchase through any affiliate links on this website and within this post.